Global Evolution of Plastic Cups: From Commodity to Sustainable Innovation

News 2025-06-06

1. Global Market Dynamics: Scale Expansion and Regulatory Pressures

Plastic cups, iconic symbols of modern consumerism, are undergoing a transformative journey amidst conflicting forces of market growth and environmental urgency. The global disposable plastic cup market, valued at $32.6 billion in 2025, continues to surge driven by on-the-go lifestyles—China alone consumes over 85 billion units annually, mirrored by rising demand in Southeast Asia and Latin America where coffee and bubble tea cultures boom. Simultaneously, the smart cup segment, integrating IoT and health-tracking features, is exploding with a 22% CAGR, led by brands like Xiaomi (40% market share) and Thermos’ Bluetooth-enabled hydration systems.

Yet, this growth is shadowed by stringent global regulations. The EU’s Packaging and Packaging Waste Regulation (PPWR, 2025) mandates 30% recycled content in plastic cups by 2030, while China’s upgraded “Plastic Ban” bans non-degradable cups in catering by 2025, creating a $50 billion opportunity for bio-based materials. In the U.S., California’s SB 54 Law requires 25% recycled plastic in packaging by 2032, forcing a global shift from traditional PET/PP dominance (65% market share in 2023) to sustainable alternatives.

2. Material Revolution: Global Innovations in Sustainability

2.1 Breakthroughs in Biobased & Circular Materials

- PLA (Polylactic Acid): Leading the green wave, NatureWorks’ Ingeo™ PLA cups, certified by the U.S. BPI and EU OK Compost, degrade in industrial facilities within 12 weeks, now used by 7-Eleven in Japan and Starbucks in Canada. Though 40% costlier than PET, their carbon footprint is 60% lower.

- Ocean-Bound Plastics: Patagonia-backed rePurpose Global channels marine plastic waste into rPET cups, with brands like Costa Coffee using 25% ocean-bound recycled content, reducing reliance on virgin polymers.

- Nanocomposites: South Korean researchers developed cellulose-nanocrystal reinforced PP, boosting heat resistance to 135°C (vs. standard PP’s 120°C) while maintaining 100% recyclability, adopted by McDonald’s APAC for hot beverage cups.

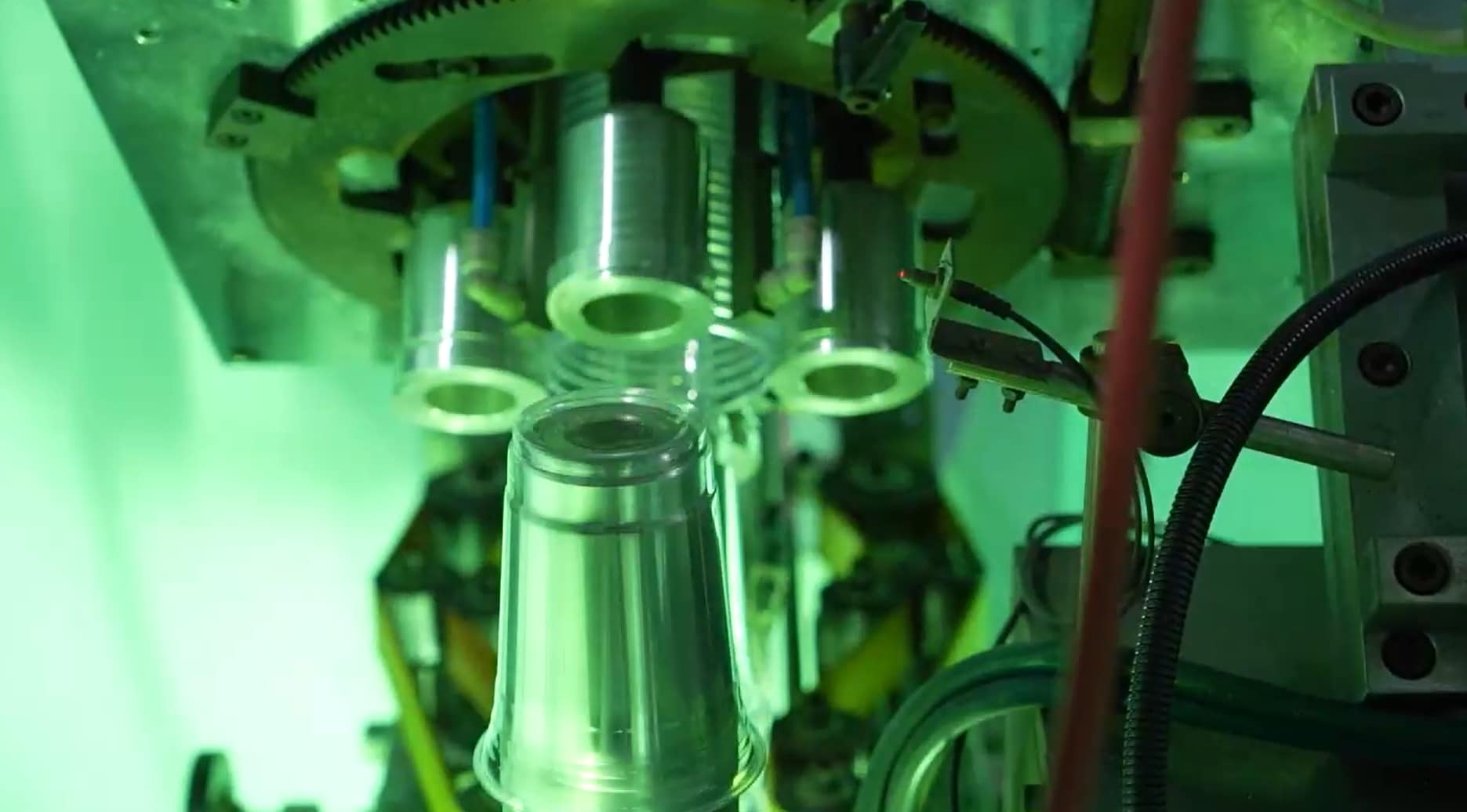

2.2 Manufacturing Innovation Across Continents

- AI-Driven Production: Germany’s Krones AG uses machine learning to optimize injection molding, achieving 99.1% yield for PP cups and cutting energy use by 18%.

- Closed-Loop Systems: Australia’s CupClub pioneered a circular model where reusable cups are tracked via QR codes, sanitized in central hubs (capable of 50+ uses), and returned to 3,000 partner cafes, reducing waste by 72% in Melbourne trials.

- Edible Packaging: London-based Notpla’s seaweed-based “Ooho!” capsules, trialed at the Tokyo Olympics, dissolve in water or soil within 4 weeks, offering a zero-waste solution for sports and festivals.

3. Consumer Paradigm Shift: Global Demands for Safety & Purpose

3.1 Informed Selection: A Global Guide

- Material Literacy: Educating consumers on resin codes—”1″ for PET (cold drinks only, ≤70°C), “5” for PP (microwave-safe, 120°C), and “7” for Tritan™ (BPA-free, ideal for baby bottles, adopted by Avent globally).

- Regulatory Compliance: Global brands now display dual certifications—FDA (USA), LFGB (Germany), and GB 4806 (China)—to build trust in cross-border e-commerce, with Amazon mandating compliance for all cup listings.

- Health Risks: A 2025 study by the International Journal of Environmental Research linked repeated use of PET cups to microplastic ingestion (average 1,900 particles/year), driving demand for durable, recyclable PP and glass-lined options in Europe.

3.2 Branding Beyond Functionality

- Cultural Customization: In the Middle East, Almarai prints Arabic calligraphy on yogurt cup lids, boosting brand recall by 35%, while in Brazil, Brahma Beer uses UV-reactive ink on FIFA World Cup cups, creating social media buzz.

- Carbon Transparency: Swedish brand EcoCup 率先 prints “Carbon Footprint Labels” (e.g., “This cup saves 0.08kg CO₂ vs. PET”), leveraging EU’s Corporate Sustainability Reporting Directive (CSRD) to appeal to conscious consumers—62% of Germans say such labels influence purchases.

- Smart Engagement: Starbucks’ “Reusable Cup Reward” program in 28 markets offers discounts for bringing personal cups, integrating with app-based loyalty systems to drive 15% higher repeat visits.

4. Future Trends: Global Collaboration for Circularity

4.1 Policy-Driven Innovation Hubs

- EU Circular Economy Hub: Rotterdam’s Plastic Pact unites 200 companies to develop 100% recyclable cup designs, with a target of 50% recycled content by 2028.

- ASEAN Bioplastic Alliance: Thailand, Vietnam, and Indonesia collaborate on PLA production using local cassava waste, aiming to reduce regional dependency on fossil-based plastics by 40% by 2035.

- U.S.-China Tech Exchange: Joint research between MIT and Tsinghua University focuses on enzymatic degradation of PLA, reducing composting time from 12 weeks to 5 days, set for pilot deployment in 2026.

4.2 Economic Models Reinvented

- Cup-as-a-Service (CaaS): Denmark’s Cupffee rents premium reusable cups via app, charging 0.50perusewitha2 deposit, achieving a 98% return rate in Copenhagen—similar models are scaling in NYC and Tokyo.

- Extended Producer Responsibility (EPR): Canada’s EPR framework holds manufacturers accountable for 75% of cup recycling costs by 2030, incentivizing design for recyclability (e.g., single-material structures over multi-layered composites).

- Blockchain Traceability: Nestlé uses IBM Blockchain to track rPET cups from ocean waste collection in Indonesia to European factories, providing consumers with 扫码 supply chain transparency—a feature valued by 83% of global millennials.

5. Conclusion: Redefining Global Value Chains

The story of plastic cups embodies humanity’s quest to balance convenience with planetary health. As regional regulations converge into a global sustainability framework—from EU’s PPWR to China’s Circular Economy Development Plan—innovation is no longer optional but existential. Companies that master the trifecta of material science, digital traceability, and cultural relevance will dominate the $45 billion sustainable cup market by 2030.

For global consumers, every cup choice now carries a planetary impact. The era of “throwaway” plastics is ending; what emerges is a circular ecosystem where technology, policy, and consumer action create a world where even the simplest product—the plastic cup—becomes a symbol of shared responsibility.

Check the products immediately: https://www.jypetcup.com/category/product/pet-cup/